The Help to Buy scheme (HTB) was introduced back in 2013 with the aim of helping people buy a new build home without the need for a large deposit. However, in March 2023 the scheme will come to an end, leaving a gap in the support available for buyers. And this comes at a time when house prices and the cost of living are increasing, making it potentially more difficult to get onto the property ladder.

Help to Buy has supported around a third of all new build home sales since it was launched in April 2013 – 339,347 properties from April 2013 to June 2021.

So what is next for buyers of new builds when it comes to financial support? What will the impact be on new build home sales? What will fill the gap in the market that Help to Buy will leave?

We’ll look at these questions and at the differing opinions about the impact Help to Buy has had.

The impact of Help to Buy

For people looking to purchase a new build, the Help to Buy scheme has given them the opportunity to do so with just a 5% minimum deposit (more than half of all Help to Buy purchases were made with just a 5% deposit) at a time when the average house deposit has been 24.2%.

With this 5% deposit, buyers could borrow up to 20% of the value of a property with an equity loan from the government, interest free for the first five years. This means wannabe homeowners only need a mortgage for the remaining 75%, which all helps to secure better mortgage rates and lower monthly repayments.

All of this has helped buyers to not only get on the housing ladder but in many cases to also afford homes that might have been out of their reach otherwise. Has this been Help to Buy or Help to Buy BIGGER?

With the scheme only available for new builds, it has been great for developers. Anything that improves affordability for purchasers will always drive sales. But has it also driven up prices/profits?

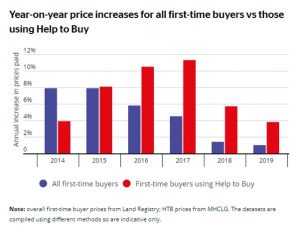

A report by Which in June 2020* reported that as the Help to Buy scheme’s popularity increased, so too did its price tag. Between April 2013 and the end of 2019, the average price paid by first-time buyers in England for any type of home increased by 39%. The average amount paid by all buyers of new-build properties also increased by 39%. But the amount paid by first-time buyers using Help to Buy jumped by a much heftier 51%.

Source Which: https://www.which.co.uk/news/2020/06/exclusive-one-in-seven-help-to-buy-homes-lose-value-despite-local-house-prices-soaring/

In April 2021, Help to Buy was changed to be only available for first time buyers and regional property price caps were introduced. As yet, we do not have full data from government to access the impact the changes to the scheme have had.

The latest official statistics the government have published is from December 2021 show that between 1 April and 30 June 2021, 10,824 properties were bought with an equity loan.

In the previous quarter, between 1 January and 31 March 2021 (prior to the scheme changes being implemented), the Help to Buy data reveals that 15,341 properties were bought with an equity loan.

From the Q1 and Q2 2021 data available it would suggest that the changes to the scheme have contributed to a reduction in the total number of properties purchased through the scheme. This may be skewed by consumers ‘getting in’ before the changes come into force on April 1st and potentially a reduction in the number of developers offering Help to Buy since April 2021.

Data to 30 September 2021 for the scheme is released on 17th February and this is when we should start to understand the longer-term impact the changes have had.

However, the scheme hasn’t been universally popular. A House of Lords report from earlier this year determined that Help to Buy has not been ‘good value money’ for the taxpayer, with a forecast bill of £29 billion by the time it finishes.

The report stated that Help to Buy has made it more difficult and expensive to buy a new home in some areas with the value of new build homes pushed up by ‘more than the subsidy value’ and buyers having paid more than they would if the scheme hadn’t existed.

The report concluded that the money spent on Help to Buy would have been more effectively spent on building more new homes, which would be more likely to result in more affordable house prices: “In the long term, funding for home ownership schemes do not provide good value for money, which would be better spent on increasing housing supply.”

Some buyers have also found that Help to Buy had a sting in the tail when they have sold their properties. The government loan is repaid as a percentage of the property’s value, rather than a set cash sum, so with the surge in house prices over recent years, this has meant that the 20% loan debts have also risen sharply.

What’s next?

Although there is as yet no replacement lined up for the Help-to-Buy equity loan scheme, there is a replacement for the Help-to-Buy ISA. The new Lifetime ISA (LISA) offers a similar 25 per cent bonus on savings, though since you can deposit more each year (and over a longer timeframe) the total bonus is potentially much bigger (up to £1,000 a year, over a maximum 32 years). The bonus is also paid at the end of each tax year – rather than on home completion – making it potentially more useful for first-time buyers. Savers can also invest as well as save in cash.

Given the mixed reaction to the scheme, it’s perhaps no surprise that there’s an equally mixed attitude towards it coming to an end, with a survey of mortgage brokers finding that 80% thought that the end of Help to Buy would have ‘little to moderate’ impact on their business and customers. They were much more concerned about housing supply issues, with 40% citing that as a challenge.

So, the question that remains about Help to Buy’s legacy is whether schemes like this are the best way to help people get on the property ladder?

Or are we going to see increased investment in Shared Ownership to elevate it as a mainstream route to purchase or will Fin Tech drive things forward with the likes of Generation Home, Stride Up, Tembo and Proportunity lead the charge in helping people get onto the property ladder?