The UK’s High Streets have been fighting survival long before the Coronavirus pandemic began. The ‘death of the High Street’ has been considered inevitable for at least the past decade, due to the rise of eCommerce. Driven by a demand from digital-first Millennial (23-36) and Gen Z (16-22) consumers, online shopping is expected to account for 53% of all retail sales by 2028, threatening the traditional retail landscape.

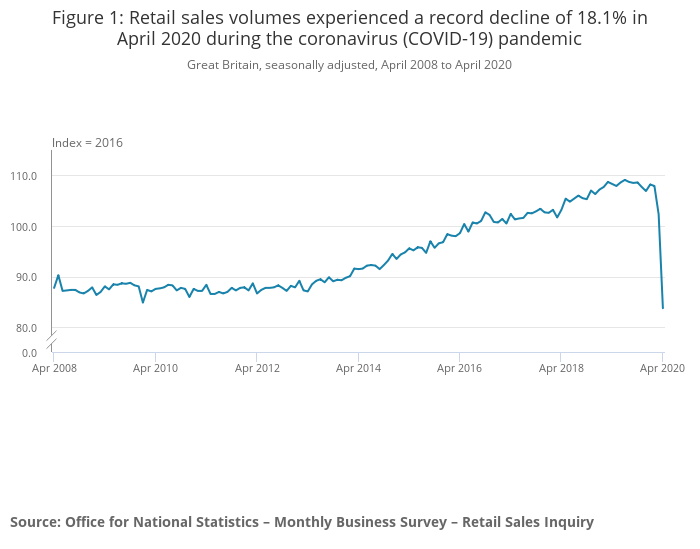

Coronavirus has amplified this propensity to shop online. The closure of High Street stores and Government’s implementation of lockdown effectively made eCommerce the only way to shop. Although we’ve seen a steep drop in total retail sales (18.1% month-on-month in April, a record decline), online shopping as a proportion of all retail reached a record high in April at 30.7%.

Digital-first retailers like Boohoo and ASOS have largely continued with ‘business as usual’. They benefit from personalisation and tech capabilities that enhance the online shopping experience. For example, ASOS’s Augmented Reality (AR) ‘See My Fit’ tool allows you to virtually try on clothes from the comfort of your own home to see what size will fit best, replicating the physical in-store experience. Features like this have left traditional brick-and-mortar retailers lagging behind, unable to compete in the digital landscape.

High Street retailers need to contend with the personalisation, convenience and price-matching offering that online shopping brings. With lockdown making more people accustomed to shopping online, it’s even more important for brick-and-mortar businesses to come up with innovative and differentiating strategies. They will need to have a USP and a strong value proposition that engages consumers (especially Gen Z and Millennials) and encourages them to shop in-store again.

Something that will certainly help drive engagement is incorporating more tech into the physical shopping experience. Investing in AR and AI technology and linking the in-store experience with mobile devices can help to make that experience more immersive. This “phygital” experience, combining the physical world with digital tech, adds an interesting dimension and is likely to be a more compelling reason for young consumers to shop in-store. Selfridges launched their ‘New Order’ campaign last year, which features boundary-breaking creative. As part of the campaign ‘Digital Falls’ was incorporated into their flagship store in London. Invisible to the naked eye, the artwork could only be seen with the use of a tablet or mobile device creating a truly engaging experience for visitors.

Digital-first brands like Glossier have already realised the importance of combining the digital and physical. Recognising that to truly capture the hearts and minds of consumers it’s still important to bring the brand to life through a physical experience, Glossier launched pop-up stores, which provide a unique experience as an ultimate expression of the brand. Perhaps our High Street retailers will come to realise the potential for innovative concept stores that go beyond the traditional physical shopping experience.

https://www.instagram.com/p/B5Ti5aoh8p1/

There is also a broader issue threatening the recovery of the High Street: consumer sentiment. Consumers are likely to be more cautious as we start to move into a post-Covid-19 period. A lack of confidence, whether from having a lower disposable income or due to a more general feeling of uncertainty, will be detrimental to the recovery of our High Streets. A positive sentiment relies on consumers feeling assured in the recovery of society as a whole, the economy and especially their personal financial situation.

Sentiment is also affected by the perception of how ‘safe’ our High Streets are. Many consumers feel a sense of anxiety associated with going back to crowded public spaces. Retailers need to carefully plan how to reopen safely and launch a compelling communication strategy that will both inform and reassure the public. However, the question is whether implementing such measures will drive consumers back to our High Streets, or if consumers have started to habitualise shopping online and feel it’s an unnecessary ‘risk’ to go back to shopping in-store.

High Street businesses, affiliated organisations and local Councils will have to come up with innovative ways to encourage people to come back to the High Street. This means competing with digital-first retailers and strategically positioning the UK’s High Streets as important places. High streets have always been the central hubs of communities, playing a key role in place-making. They are a space for people to come together, facilitating interaction and communication, a crucial part of building a ‘community’. The lockdown period has demonstrated the importance of human interaction, and perhaps this realisation will drive people back to our High Streets.

There won’t be an easy path to recovery for the UK’s High Streets following this tumultuous period. What is clear is that the post-Covid-19 period will result in ‘new beginnings’. We will have to wait and see how consumers respond, and whether the community spirit we’ve seen fostered throughout lockdown will be there to support our High Streets.