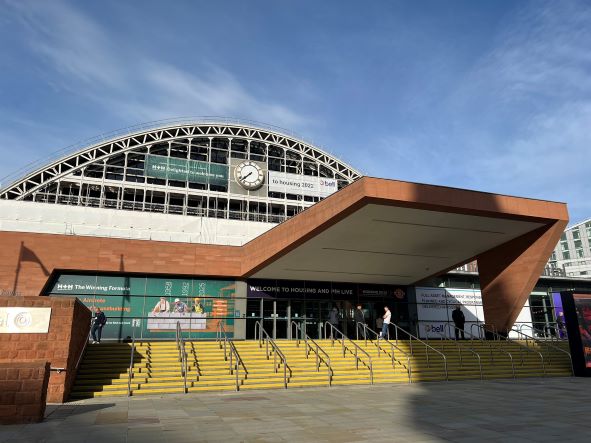

There was only one festival to be at this June if you work across the housing and residential sectors – and that’s last week’s Housing 2022, the biggest housing festival in Europe.

From net zero, sustainable communities and ESG, through to resident voice, customer service and taking climate change to future generations, team Social was engaged (and helping to engage) across the key issues of the week.

It’s a conference that tends to attract people from a whole raft of housing backgrounds, and to its credit has increasingly put more focus on tenant voice in recent years.

It is not necessarily the event of choice for a finance audience (who are well-catered for elsewhere, but the issues that Housing tackles are inherently linked to funding, finance and investment.

This was plain to see on the Unlock Net Zero stage, where the funding conundrum around decarbonisation continued to dominate. The sector is facing a dual challenge – building efficient zero carbon new stock and the retrofit of its existing portfolio to make it energy efficient. This is going to require a combination of public and private sector funding, with a new dynamic approach to funding structures given the scale of the challenge ahead.

These views were reinforced by two roundtables Social Invest director Luke Cross chaired covering the future of environmental, social and governance (ESG), and what makes for successful sustainable communities.

The former attracted an excellent panel to discuss the future of ESG and sustainable finance – Lloyds, NatWest, Sustainability for Housing, Ritterwald, HACT, Hyde, Ilke, L&Q, CHP, Housing Solutions, Trowers and Hamlins, Regulator of Social Housing, Bevan Brittan, Winckworth Sherwood, Connected Places Catapult and more…

Lenders were keen to say they are working hand-in-hand with borrowers on their ESG commitments – including how they shape ESG products, and offer flexibility as ESG KPIs or measures evolve over time. Other sectors really can take a lot from the way the UK affordable housing sector is approaching sustainable finance.

Another interesting part of the discussion was about how people define ESG – how different interpretations of it are shaping perceptions, and who and what it’s really for.

That includes the potential for ESG to go well beyond financial stakeholders and become a powerful tool to promote transparency and accountability among residents and customers.

When it comes to housing, and wider real estate – finance and ESG issues really are everyone’s business.

* For more, see Luke’s latest blog – ESG: a common language or lost in translation? – which touches upon some of the negative headlines around ESG in recent months, and provides some practical advice on embarking on an ESG approach.